If you’re planning to buy a home in Northeast Florida, understanding how to finance it is a crucial part of the journey. From loan types and interest rates to credit scores and down payments, there’s a lot to navigate.

In this guide, we’ll break down everything you need to know about financing your home in Jacksonville, so you can make smart financial decisions with confidence.

Why Financing Matters More Than Ever

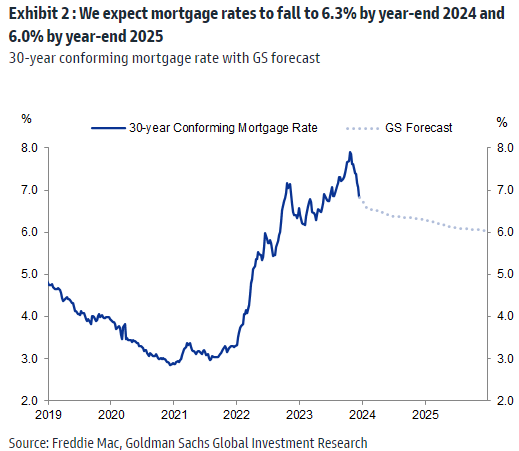

As of mid-2025, mortgage rates have remained relatively stable, with the national average for a 30-year fixed mortgage sitting at 6.85% (AP News). In a shifting market like Jacksonville, selecting the right financing strategy can save you tens of thousands of dollars over the life of your loan.

Whether you’re a first-time buyer or upgrading to a larger home, financing your home in Jacksonville starts with knowing your numbers.

Loan Options Available in Jacksonville

There are multiple loan programs available to help you finance your home in Jacksonville, depending on your financial profile, credit score, and down payment amount.

Popular Mortgage Types:

- Conventional Loans: Ideal for buyers with good credit and steady income

- FHA Loans: Lower credit score and down payment requirements

- VA Loans: No down payment for eligible veterans and active military

- USDA Loans: Designed for rural/suburban areas (some parts of Northeast Florida qualify)

Tip: Always get pre-approved to understand your budget before starting your home search.

Get started with home buying tools and resources at River Birch Realty.

Understanding Your Credit and Budget

Your credit score plays a big role in how much home you can afford and what interest rate you’ll qualify for.

General Guidelines:

- 740+ = Best interest rates

- 680–739 = Good

- 620–679 = Fair (FHA-friendly)

- Below 620 = May require specialized loan programs

Beyond credit, consider your:

- Debt-to-income ratio (DTI)

- Monthly expenses vs. net income

- Down payment availability

- Emergency fund reserves

Use tools like the FHA mortgage calculator to estimate your monthly payments.

First-Time Buyer Programs in Florida

Florida offers several programs to support homebuyers through down payment assistance, tax credits, and favorable loan terms.

Notable Options:

- Florida Hometown Heroes Housing Program: For essential workers

- Florida Assist: Deferred second mortgage to help with down payments

- 3%–5% Grants: Through participating lenders

Talk to a River Birch Realty expert to connect with trusted local lenders.

Pre-Approval vs. Pre-Qualification

While often used interchangeably, pre-approval and pre-qualification are different.

| Feature | Pre-Qualification | Pre-Approval |

| Credit Check | No (usually) | Yes |

| Verified Income | No | Yes |

| Strong Offer Signal | Low | High |

| Use in Offer Letter | Not ideal | Recommended |

A pre-approval letter makes your offer more competitive, especially in popular Jacksonville neighborhoods.

Talk to a Trusted Agent First

Financing your home in Jacksonville doesn’t have to be overwhelming. A real estate agent with local connections can help you:

- Connect with the right lender

- Understand hidden costs (HOA, insurance, taxes)

- Negotiate contingencies and timelines

- Stay on budget without sacrificing your goals

Contact River Birch Realty for a personalized buyer roadmap.

Final Thoughts

Whether you’re buying your first home or your fifth, financing your home in Jacksonville is a critical part of the journey. By understanding your loan options, improving your credit, and working with the right professionals, you can secure a loan that works for your lifestyle and long-term goals.

With deep local experience and trusted lender partnerships, River Birch Realty is here to help you from pre-approval to closing day.

Let’s Make Your Move Happen

📍 Visit River Birch Realty

📞 Call (904) 945-5610

📧 Email katrinaleek@riverbirchjax.com