With average 30-year mortgage rates hovering around 6.8–6.9% in 2025, affordability is a top concern for homebuyers across Northeast Florida. That’s where local real estate agencies in Jacksonville, Florida (like River Birch Realty) play a crucial role in helping buyers and sellers manage, mitigate, and strategize around rising rates.

This blog post explores how expert agencies guide clients from pre‑approval to post‑purchase and share financial insights, negotiation tactics, and timely support to ensure success in a high-rate market.

1. Pre-Approval: Locking In at the Right Time

Securing pre-approval early can protect against even modest rate increases. With 30‑year rates fluctuating between 6.5–6.9%, every 0.25% difference affects your loan capacity and monthly payment.

- A $400K mortgage at 6.9% results in a $2,643/mo principal + interest, versus $2,488/mo at 6.5%.

- Realtors suggest early pre-approval boosts credibility and strengthens offers in a competitive landscape.

River Birch Realty connects buyers to mortgage pros who quickly lock rates, perform affordability analysis, and offer tailored financing options.

2. Market Timing & Offer Strategy

Higher rates have extended listing periods. In Jacksonville, only 1 in 6 homes now sells monthly, with inventory up 68% year-over-year, averaging 60 days on market.

- Strategic patience allows buyers to find value without overpaying.

- When rates later dip, sometimes just by 0.3%, it stimulates buyer activity

River Birch agents monitor market fluctuations, alert clients to window opportunities, and advise on optimal timing.

3. Negotiation Tools: Seller-Paid Rate Buydowns

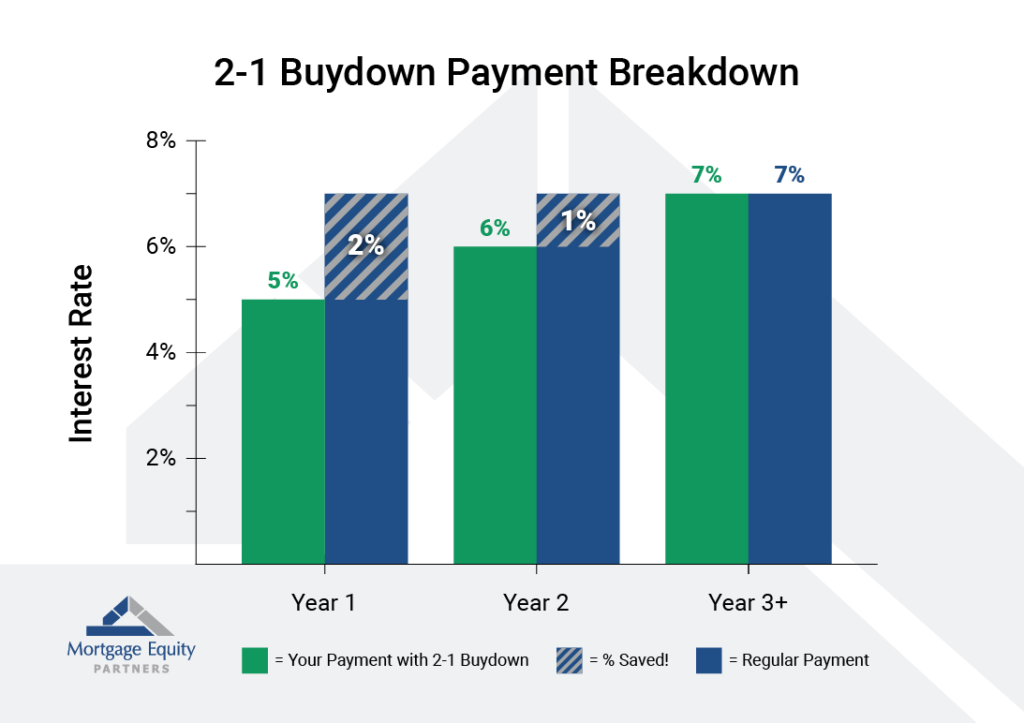

Seller-paid rate buydowns are emerging as a key strategy in 2025:

- A 2-1 buydown can slash the initial rate by 2%, saving buyers $500/month early on, funded by seller credits.

- Builder-led incentives (Lennar, D.R. Horton) often include buydowns and closing-cost coverage (read: AP news’ article).

River Birch agents help draft offers with buydown clauses or temporary buydown credits, negotiating strongly on behalf of clients.

Image source: mortgage equity partners

4. Loan Options & Long-Term Planning

High rates aren’t just a snapshot; they’re a trend. Agencies guide serious buyers to flexible options:

- Adjustable-rate mortgages (ARMs) and 2-1 buydowns ease early payments

- FHA, VA, and USDA loans offer lower upfront costs for qualifying buyers

- Refinance readiness: River Birch agents plan exit strategies if rates drop later

5. Financial Education & Local Insight

Local agents often host workshops on rate strategies and affordability. Research shows 62% of Gen Z and millennial buyers are delaying purchases until they get clearer rate outlooks.

River Birch Realty partners with Jacksonville loan professionals for webinars covering:

- Rate trend forecasts and Fed policy impacts

- Reviewing long-term housing costs vs rent

- Pre-approvals and buydown strategies

6. Post-Purchase Support: Refinance & Budget Wellness

Once your home closes at a high rate:

- River Birch follows up to evaluate future refinance opportunities if rates drop

- Buyers receive guidance on budgeting, insurance, taxes, and HOA costs, so higher payments don’t mean financial strain

Key Takeaways

Working with local real estate agencies in Jacksonville, Florida, offers flexibility and foresight in navigating a high-rate 2025 market.

| Step | Strategy |

| Pre-Approval | Lock rates early, and understand affordability |

| Timing | Wait for dips, avoid urgency bias |

| Buydowns | Negotiate seller-funded rate relief |

| Loan Structuring | Consider ARMs, federal loans, and refinance planning |

| Education | Use webinars, lender insights, and budget planning |

| Follow-Up | Plan for refinance and financial wellness |

Ready for Personalized Guidance?

📍 Visit River Birch Realty

📞 Call (904) 945‑5610

📧 Email katrinaleek@riverbirchjax.com

Edge your purchase with strategic rate and financing expertise from real estate agencies in Jacksonville, Florida, and let River Birch be your guide.