How High Mortgage Rates Are Influencing Jacksonville Homebuyers

In 2025, rising interest rates are top of mind for anyone navigating the Northeast Florida housing market. With 30-year fixed mortgage rates hovering near 7%, affordability and timing have become central to how buyers approach the process.

In this post, we’ll explore how high mortgage rates in Jacksonville are shaping buyer decisions — and how you can still make a smart, strategic move in today’s market.

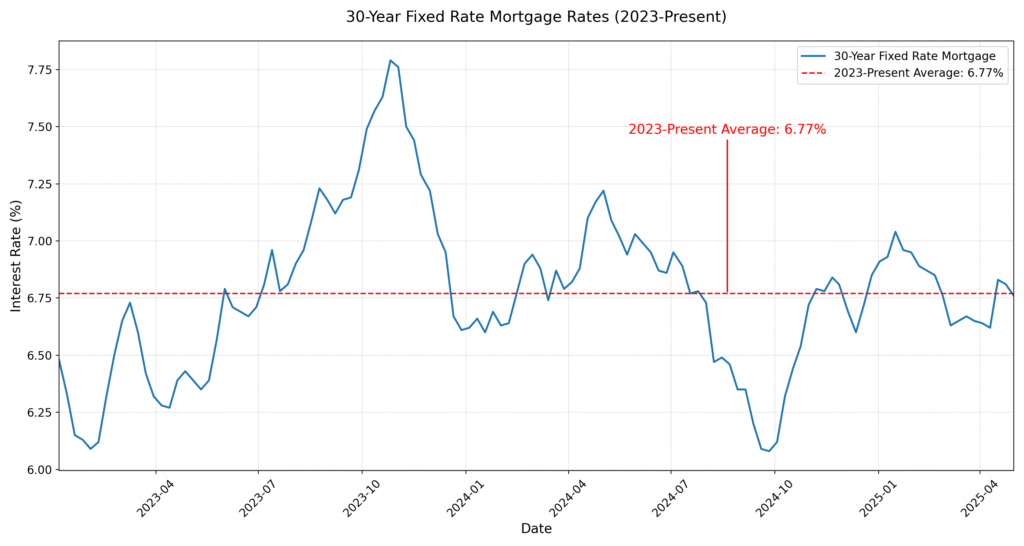

Mortgage Rate Snapshot: Where Things Stand

According to Freddie Mac, the average 30-year fixed mortgage rate in April 2025 is 6.77%, more than double what buyers enjoyed just a few years ago.

In Jacksonville:

- Monthly mortgage payments have increased by over $700/month on a $400K home (compared to 3.25% rates)

- First-time buyers are adjusting their price range and loan structure

- Demand is still present, but buyers are more cautious and prepared

How High Mortgage Rates Are Reshaping Buyer Strategy

Higher rates affect more than just your payment — they influence your buying strategy, negotiation leverage, and financial planning.

1. Lower Budget, Same Expectations

Buyers are shopping smarter. With higher payments, they’re:

- Scaling down square footage or location expectations

- Prioritizing move-in-ready homes to avoid renovation loans

- Looking at value-driven suburbs like Fleming Island and Southside

Explore Affordable Communities with River Birch Realty

2. Flexible Loan Structures

More buyers are exploring:

- Adjustable-rate mortgages (ARMs) to lock lower short-term rates

- 2-1 buydown programs offering reduced rates for the first 2 years

- Government-backed loans like FHA and VA with lower down payment requirements

Impact on the Jacksonville Housing Market

Jacksonville remains one of Florida’s most desirable metros, but high mortgage rates are slowing price growth and extending days on market.

Current Trends (as of May 2025):

- Median Home Price in Jacksonville: $302,000

- Days on Market: 60+ days on average (up from 42 a year ago)

- Seller Behavior: More open to price reductions and concessions

Buyers are now in a better position to:

- Negotiate seller-paid closing costs

- Ask for repair credits or furniture inclusion

- Wait out overpriced listings

What River Birch Realty Recommends

Navigating high mortgage rates in Jacksonville requires more than pre-approval — it requires a smart, flexible approach and expert guidance.

River Birch Realty helps buyers:

- Reassess budget ranges using updated affordability tools

- Time the market by understanding seasonal patterns

- Leverage local lender relationships for better mortgage terms

- Negotiate strategically in neighborhoods with rising inventory

Want help understanding how rates affect your budget? Contact a River Birch Agent Today

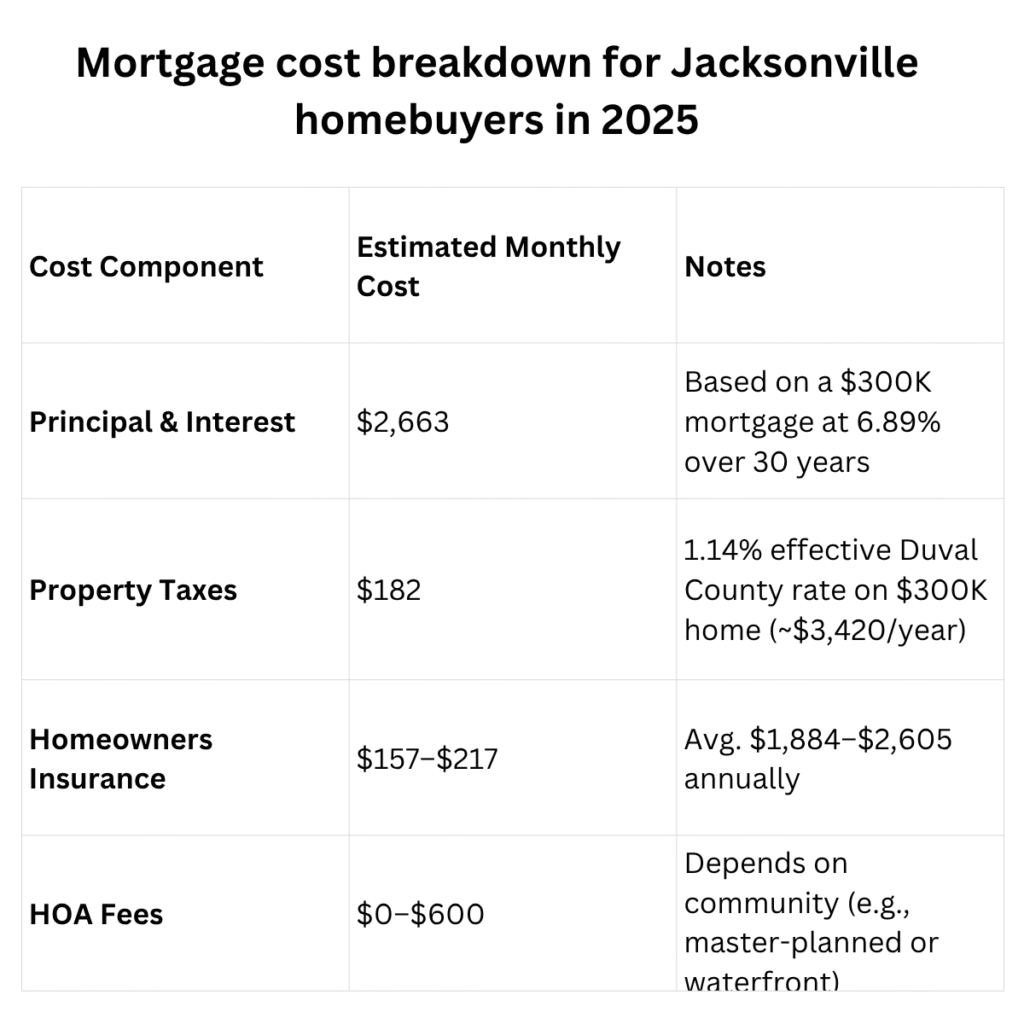

Tip: Focus on Total Affordability — Not Just Rate

While rates are important, affordability depends on the total monthly cost, including:

| Cost Component | What to Expect |

| Mortgage Interest | 6.89% (national avg) |

| Property Taxes | ~1.02% of home value (Duval County) |

| Insurance | $1,000–$2,000/year in NE Florida |

| HOA Fees | $200–$600/month, depending on area |

Even with higher rates, buyers can still win by choosing lower-tax communities, negotiating repairs, or using mortgage credits.

Final Thoughts

High mortgage rates in Jacksonville are changing how buyers plan and purchase — but with the right strategy, your goals are still within reach.

River Birch Realty helps clients align their finances, market timing, and property priorities so they can make confident decisions despite rising rates.

Ready to Buy Smart in Today’s Market?

📍 Visit River Birch Realty

📞 Call (904) 945-5610

📧 Email katrinaleek@riverbirchjax.com